As a core concept in modern accounting, this provides the basis for keeping a company’s books balanced across a given accounting cycle. In above example, we have observed the impact of twelve different transactions on accounting equation. Notice that each transaction changes the dollar value of at least one of the basic elements of equation (i.e., assets, liabilities and owner’s equity) but the equation as a whole does not lose its balance. If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation.

Get in Touch With a Financial Advisor

If a business buys raw materials and pays in cash, it will result in an increase in the company’s inventory (an asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting. Assets represent the valuable resources controlled by a company, while liabilities represent its obligations. Both liabilities and shareholders’ equity represent how the assets of a company are financed. If it’s financed through debt, it’ll show as a liability, but if it’s financed through issuing equity shares to investors, it’ll show in shareholders’ equity. The accounting equation is also called the basic accounting equation or the balance sheet equation.

Company

- Metro Corporation collected a total of $5,000 on account from clients who owned money for services previously billed.

- The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000).

- The capital would ultimately belong to you as the business owner.

- If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement.

At this time, there is external equity or liability in Sam Enterprise. The only equity is Sam’s capital (i.e., owner’s equity amounting to $100,000). The rights or claims to the properties are referred to as equities. So, let’s take a look at every element of the accounting equation. Incorrect classification of an expense does not affect the accounting equation.

Financial statements

Finally, a corporation is a very common entity form, with its ownership interest being represented by divisible units of ownership called shares of stock. Corporate shares are easily transferable, with the current amazon go cashierless store of the future has some new competition holder(s) of the stock being the owners. Earnings give rise to increases in retained earnings, while dividends (and losses) cause decreases. Income and expenses relate to the entity’s financial performance.

The more knowledge you have regarding your finances, the more efficiently you can run your business and make profit. A thorough accounting system and a well-maintained general ledger helps assess your company’s financial health accurately. There are many more formulas that you can use, but the eight covered in this article are undoubtedly key for a profitable business. A high debt-to-equity ratio illustrates that a high proportion of your company’s financing comes from issuing debt, rather than issuing inventory to shareholders. Suppose you’re attempting to secure more financing or looking for investors.

What Is Shareholders’ Equity in the Accounting Equation?

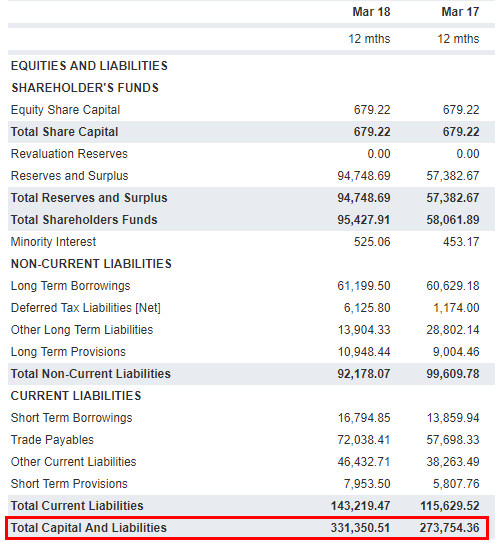

The balance sheet is also referred to as the Statement of Financial Position. The accounting equation helps to assess whether the business transactions carried out by the company are being accurately reflected in its books and accounts. We know that every business holds some properties known as assets. The claims to the assets owned by a business entity are primarily divided into two types – the claims of creditors and the claims of owner of the business.

This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation. In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly. Thus, the accounting equation is an essential step in determining company profitability.

We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. Our Accounting Equation Cheat Sheet provides eight transactions to illustrate why and how the accounting equation remains in balance. An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future. For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future.

It is sometimes called net assets, because it is equivalent to assets minus liabilities for a particular business. ” The answer to this question depends on the legal form of the entity; examples of entity types include sole proprietorships, partnerships, and corporations. A sole proprietorship is a business owned by one person, and its equity would typically consist of a single owner’s capital account. Conversely, a partnership is a business owned by more than one person, with its equity consisting of a separate capital account for each partner.