Multiply the weight individually by each value and add the results together. This total number is the denominator in the weighted average formula. Add up all the products from the previous step to get a single numerator for the weighted average formula.

Method 1: When the Weights Add Up to One

The weighted average gives each of the different quantities a specific weight. The weights are essentially numerical expressions expressed as percentages, decimals, or integers; they do not correspond to any physical units. When the numbers in a data collection are given the same weight, a simple average can be less accurate than a weighted average. Each number in a data set is multiplied by a predetermined weight value during the calculation of the weighted average. The final step is to add these two values together and divide it by the number of research participants, giving us the weighted average. Here, we’ll give you examples of weighted average calculations with real numbers to provide insight into the exact process.

What Is the Purpose of a Weighted Average?

That is, the contribute a greater or a lesser amount to the final grade. Finding the weighted average is different compared to finding the normal average of a data set. This is because the total will reflect that some of the bits of data hold more weight or significance than others. Spreadsheet software like Microsoft Excel and Google Sheets are powerful tools for calculating weighted averages efficiently.

How to Calculate Weighted Average

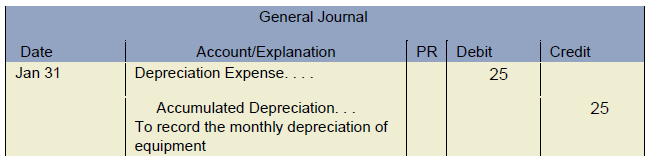

A mistake in giving weights can change the results, which could lead to wrong conclusions. To be sure of your accuracy, check the criteria for assigning weights again, and if you can, consult a peer or research paper writing help for validation. Thus, John rode his bike an average of 36.4 minutes per day over the 4 week period. About the data below, calculate, on average, how much an employer pays an employee an hour of work. Let us arrange the data in a table and use the decimal value as the weighing factor.

The first column indicates the time you spent traveling to school, which are 15 minutes, 20 minutes, 25 minutes, and 30 minutes. Once you have arranged your data, multiply each number by the correct weighing factor. Natural gas traders are often interested in the volume-adjusted all about irs tax refund accepted average price of gas in a particular region. Weighted averages provide a tailored solution for scenarios where certain data points hold more significance than others. However, there are other ways of calculating averages, some of which were mentioned earlier.

The weighted average method is mainly utilized to assign the average cost of production to a given product. It is commonly used when items within a business’s inventory are intertwined and it becomes difficult to assign a specific cost to any individual item. Finally, divide the sum of the weighted products by the sum of the weights to find weighted average.

- A normal average calculation would completely miss this detail or require more data to provide the same accurate look.

- One can fall back on this method if they want to conduct voting or any process based on proportional representation.

- Whether in finance, statistics, engineering, or manufacturing, weighted averages can be customized to suit specific needs and objectives.

- The capital includes fixed assets, cash in hand, goods, brand value.

- Weighted average has nothing to do with weight conversion, but people sometimes confuse these two concepts.

This subjectivity can introduce bias into the analysis and undermine the reliability of the weighted average. When we calculate the average of a series of numbers, we get the mean value of the numbers. The weighted average of numbers is also similar to the average but we can measure it by the frequency of its occurrence. To find the average, we are dividing it by the total number of students in the class i.e, 100. In stock and accounting, the weighted average smoothes out the fluctuations in the market.

For example, when consider calculating a grade where homework accounts for $40%$ of the final score. If there are $20$ homework assignments in a semester, each assignment is not multiplied by $0.4$. Indeed, the assignments themselves may not all have the same weight because some assignments may be longer or shorter.

Remember to convert these percents to decimals before multiplying. In these cases, calculations also tend to be easier because the weights, when they are percents, will likely add up to $100%$, which is equal to $1$. Google Sheets provides similar functionality, where the same SUMPRODUCT formula can be used. Their accessibility and ease of use make them an excellent choice for anyone needing to perform weighted average calculation, from students to professionals. In education, weighted averages are fundamental for calculating students’ GPA, considering the credit hours and difficulty level of courses. The health sector utilizes them to average patient data, taking into account the severity or frequency of conditions.

Read on as we take a closer look in our in-depth guide on the weighted average. For each point, perform a multiplication by its corresponding weight. This step gives you a series of products that represent the weighted contribution of each value. The table below shows the frequency with which he rides a certain number of minutes in a given day over the course of 28 days.