In the accounting general ledger, the credit balances of the contra purchase expense accounts reduce and offset the usual debit balances reported in the standard purchase expense accounts. But if you don’t know how to account for a return with a purchase returns and allowances journal entry, your books will be inaccurate. To have an up-to-date inventory report helps companies to run their accounting and logistics departments without hassle.

What is your current financial priority?

When a company receives the goods it ordered, it will record it as a purchase. The purchase account is an expense account that goes directly into a company’s cost of goods sold. Sometimes, however, goods received may also contain products that don’t meet a company’s requirements. Items returned can be damaged or unsellable per company policy, or they returns and allowances account is a ledger account that tracks all returns, discounts, allowances, price adjustments, etc. Made on purchases for later use as deferrals against cost of goods sold or deductions from income tax expense.

Purchase returns for when a customer paid cash

Let us understand the importance of passing the goods purchase return journal entries from the company’s point of view. The purchase returns and allowances is a temporary account which its normal balance is on the credit side. The balances of this account will offset with the purchase account and be cleared to zero when the company closes the account entries at the end of the period. When presenting the purchases figure in the financial statements, companies must account for purchase returns and allowances. Companies report these accounts as a reduction in the purchases to figure to reach net purchases.

Sales returns and allowances journal

Passing these journal entries helps companies determine the exact stock in their inventory by reducing the returns from their suppliers. The corresponding accounts are credited with the amounts debited to balance the entries. The entries are based on cash or on credit as the respective accounts have to be credited back due to the return. Purchase return is a transaction where the purchaser is not satisfied and returns goods for some reason, such as goods are defective, damaged, inferior quality, or in wrong specifications, etc. Likewise, the company will need to account for the goods that are returned back to its suppliers with the proper journal entry of purchase return.

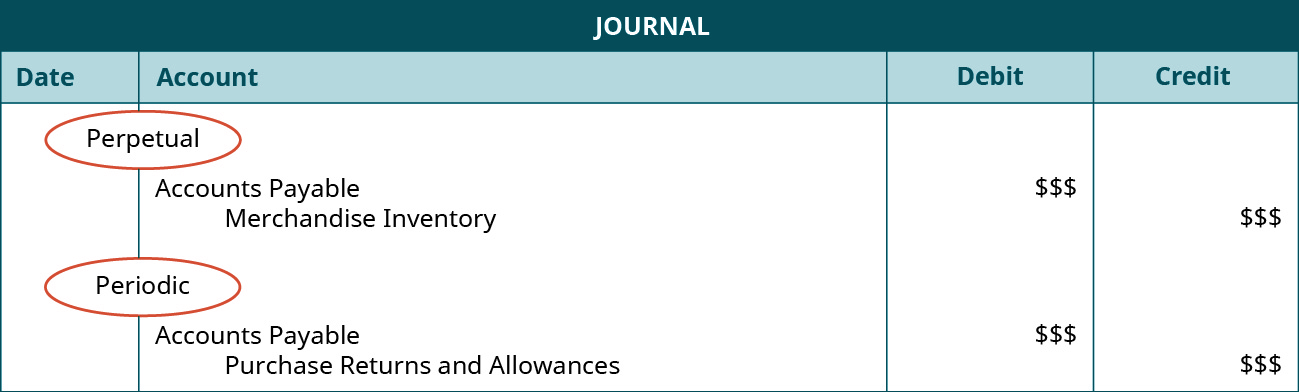

Both returns and allowances reduce the buyer’s debt to the seller (accounts payable) and decrease the cost of the goods purchased (inventory). Purchase returns and allowances is an account that is paired with and offsets the purchases account in a periodic inventory system. The best tax software for expatriates in 2021 account contains deductions from purchases for items returned to suppliers, as well as deductions allowed by suppliers for goods that are not returned. This contra account reduces the total amount of purchases made, which therefore also reduces the ending inventory balance.

Journal Entry for Purchase Returns (Returns Outward)

The purchase returns and allowances journal is used by the accounting department to record all returns and allowances made on purchases. These records are then posted into the General Ledger, where they become part of an overall return and allowance account that can be used to offset inventory purchases. Entries from the purchase returns and allowances journal are posted to the accounts payable subsidiary ledger and general ledger. There are two approaches for making journal entries of transactions related to sales returns and allowances. A company may choose any approach depending on its volume of returns and allowances transactions during the year.

Any entry relating to the return of merchandise purchased for cash is recorded in a cash receipts journal. A purchase return occurs when a buyer returns merchandise to a seller. When a buyer receives a reduction in the price of goods shipped but does not return the merchandise, a purchase allowance results. To illustrate the periodic inventory method journal entries, assume that Hanlon Food Store made two purchases of merchandise from Smith Company. Artificial intelligence (AI) and machine learning (ML) are also transforming purchase return management. AI-powered analytics can predict return patterns, helping businesses anticipate and prepare for returns more effectively.

- Automation reduces manual errors and speeds up the return process, allowing companies to focus on more strategic tasks.

- Buyers must record shipping charges as transportation in (or Freight In) when the goods were shipped FOB shipping point and they have received title to the merchandise.

- Cash and Merchandise Inventory accounts are current assets with normal debit balances (debit to increase and credit to decrease).

As mentioned, these transactions do not impact the purchases account. Nonetheless, it is crucial to understand how a company records the purchase of products or services. Regardless of whether we have return or allowance, the process is exactly the same under the perpetual inventory system.

Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. The treatment mentioned above is mainly for the scenario where the purchase had been made on credit. This is because Payables were initially a liability the business incurred against purchasing certain goods and services. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

The company passes Purchase Return Journal Entry to record the return transaction of the merchandise purchased from the supplier. Regardless of whether we have return or allowance, the process is exactly the same under the periodic inventory system. Both returns and allowances reduce the buyer’s debt to the seller (accounts payable) and decrease the cost of the goods purchased (purchases).