The accounts receivable turnover is a ratio that measures the number of times your business collects its average accounts receivable over a specific period. It can also be the case that Lewis Publishers does not make the payment within 45 days. In such a case, Ace Paper Mill would either reach out to Lewis Publishers for payment or hire a collection agency to collect the accounts receivable. Company B now makes its journal entry $500,000 under Notes Receivable. The interest accrued at the year’s end is recorded in the journal and upon payment of the ending note balance, company B will again journal the collection.

Notes Receivable in the Balance Sheet

The guarantee provision makes the note receivable easier to collect than a standard account receivable. When a note receivable originates from an overdue receivable, the payment tends how to obtain a copy of your tax return to be relatively short – typically less than one year. The examples provided account for collection of the note in full on the maturity date, which is considered an honored note.

What is a Note Receivable?

Notes represent a signed agreement clearly spelling out the borrower’s obligation to repay principal and interest. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. If the commitment is subsequently exercised during the commitment period, the remaining unamortized commitment fee at the time of exercise shall be recognized over the life of the loan as an adjustment of yield. The term remote is used here, consistent with its use in Topic 450, to mean that the likelihood is slight that a loan commitment will be exercised before its expiration.

Risk of Bad Debts

As a seller, you must be careful when extending trade credit to your customers, as you run the risk of non-payments attached to accounts receivables. The customers who may not pay for the goods sold to them are then recorded as bad debts in the books of accounts. Now, you record the money that your customers owe to you as accounts receivable in your books of accounts, which are one of the important current assets of your business. The examples provided account for collection of the note in fullon the maturity date, which is considered an honored note.

The amortized discount is added to the note’s carrying value each year, thereby increasing its carrying amount until it reaches its maturity value of $10,000. As a result, the carrying amount at the end of each period is always equal to the present value of the note’s remaining cash flows discounted at the 12% market rate. This is consistent with the accounting standards for the subsequent measurement of long-term notes receivable at amortized cost. It is common knowledge that money deposited in a savings account will earn interest, or money borrowed from a bank will accrue interest payable to the bank. The present value of a note receivable is therefore the amount that you would need to deposit today, at a given rate of interest, which will result in a specified future amount at maturity.

Accounts receivable example and journal entry

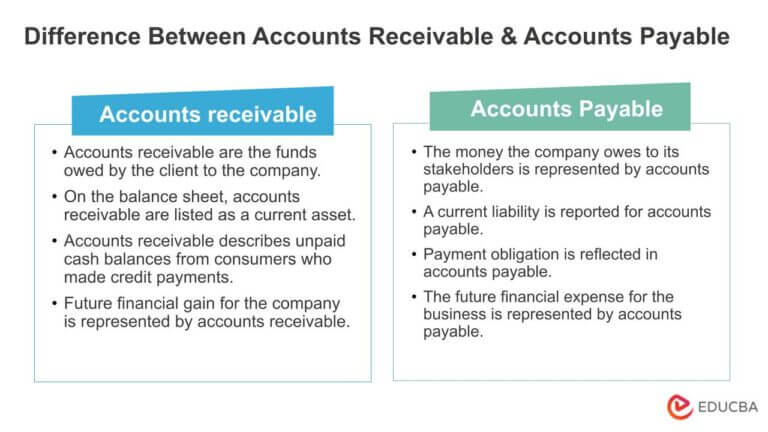

For instance, if a customer has purchased $3,000 worth of goods on credit, this amount is logged under AR, indicating future income expected from that customer. Accounts payable (AP) appears as a liability on the balance sheet, representing the money a business owes to its suppliers. For example, a retail business owes $5,000 to a supplier for recent inventory purchases. This section reflects the company’s obligations to make future payments. The discount or premium resulting from the determination of present value in cash or noncash transactions is not an asset or liability separable from the note that gives rise to it.

- When Lewis Publishers makes the payment of $200,000, Ace Paper Mill will increase the Cash Account by $200,000 and reduce Debtors or Accounts Receivable Account by $200,000.

- In many ways, accounts payable is the opposite of accounts receivable.

- The difference between accounts receivable and accounts payable becomes clear when looking at the types of transactions they cover.

- As per the above journal entry, debiting the Cash Account by $200,000 means an increase in Cash Account by the same amount.

- For example, businesses that collect payments over a period of months may have a larger dollar amount of receivables in the older categories.

- You should classify a note receivable in the balance sheet as a current asset if it is due within 12 months or as non-current (i.e., long-term) if it is due in more than 12 months.

Thus, both accounts receivable and sales account would increase by $200,000. The notes receivable is an asset whose category depends on the term of issuance. It is classified as a current asset if the note receivable is issued for less than a year. In case it is used for a longer period, the portion of the amount that is received within that year is classified as a current asset and the rest is classified as a non-current asset. Also, notes receivable are transferable i.e. its ownership can be transferred and the new bearer shall have the claim to note post the ownership transfer. Another opportunity for a company to issue a notes receivable iswhen one business tries to acquire another.

It is the business strategy which can increase sale and build a good relationship with customers. The customers have obligation to pay the accounts receivable on the due date. It will become legal evidence in the court if one party does not comply. Note receivable is recorded separately from accounts receivable on the balance sheet. It is classified as current assets or noncurrent assets depend on the term on a promissory note.